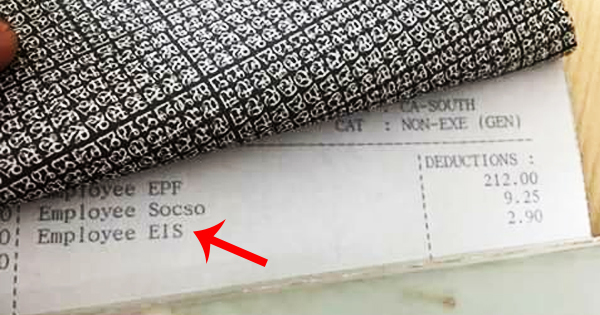

EIS Contribution Table 2022 for Payroll System Malaysia

EIS contribution Table 2022 are set at 0.4% of an employee’s estimated monthly wage. According to the EIS contribution table, 0.2% will be paid by the employer, and 0.2% will be cut from the employee’s monthly wages.

All employers in the private sector are required to pay monthly contributions on behalf of each employee. (Government employees, domestic workers and the self-employed are exempt)

An employee is defined as a person who is employed for wages under a contract of service or apprenticeship with an employer. The contract of service or apprenticeship may be expressed or implied and may be oral or in writing.

All employees aged 18 to 60 are required to contribute. However, employees aged 57 and above who have no prior contributions before the age of 57 are exempt. Contribution rates are capped at an assumed monthly salary of RM4000.00.

Eligible to Claim EIS Contribution 2022

All employees insured under the Act (known as Insured Persons) who have lost their employment are eligible with the following exceptions:

- Voluntary resignation by the Insured Person

- Expiry of the Insured Person’s fixed-term contract

- Unconditional termination of a contract of service based on an agreement between the Insured Person and his/her employer

- Completion of a project specified in a contract of service

- Retirement of the Insured Person

- Dismissal due to misconduct by the Insured Person

Applicants for benefits must prove that they are able to work, available to work and actively seeking work.

EIS Contribution Table 2022