How to submit Income Tax 2022 through e-Filing LHDN Malaysia

In Income Tax 2022, e Filing LHDN known as electronic filing is the powerful tool that can deliver significant social and economic benefit based on payroll malaysia. The major advantage of e Filing lhdn income tax 2022 is includes the ease of use, technology, reduction in rush and saves the time when user do submission Income Tax 2022 through online.

Income Tax 2022, it can provides a strong support to the government for good payroll malaysia governance and large population to pay their liabilities to the government effectively by using e Filing lhdn income tax 2022.

What is e Filing Malaysia 2022?

e Filing Malaysia income tax 2022 is an electronic application on filing of Income Tax Return Form (ITRF) through internet. It is a new and effective method of e filing malaysia income tax 2022 returns online and has electronic income tax 2022.

Who Should Submit e Filing Malaysia ?

- Any individual whose total annual income is RM34,000 and above after EPF deduction.

- Any individual who earns income from business.

- Any employee who comes under Scheduler Tax Deduction (STD).

- Any company that starts a new business.

- Any individual or company who wants to claim tax credit repayment for any deduction on dividend income.

Documents Required for Income Tax 2022 Malaysia

- Individual (without business income)

- MyKad (new identification card, armed forces or police)

- Non-citizen (without business income)

- Passport

- Individual (with business income)

- MyKad (new identification card, armed forces or police)

- Business Registration Certificate.

- Non-citizen (with business income)

- Passport

- Business Registration Certificate

- Company

- Incorporation Certificate of the company

- Superform, and particulars of office or director.

How to Register LHDN Online Malaysia?

- Go to the e-Daftar registration page and click on Borang Pendapatan Online.

- (Individuals should click on Pendaftaran Individu, and companies should click on Pendaftaran Syarikat)

- Fill in the online registration form with complete details.

- Upload your completed application form and reconfirm the application.

- You will receive an application number which you need to note down for future reference.

- Click on Muat Naik Disini to upload the required documents.

- Wait for Lembaga Hasil Dalam Negeri (LHDN) to confirm your application with a PIN number. This process would usually take a week.

- You would also receive your tax reference number through email which would start with SG and followed by 11 numbers.

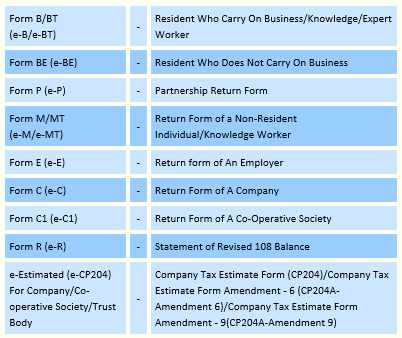

Types of Efiling LHDN Forms.

What are the e filing LHDN Process in Malaysia?

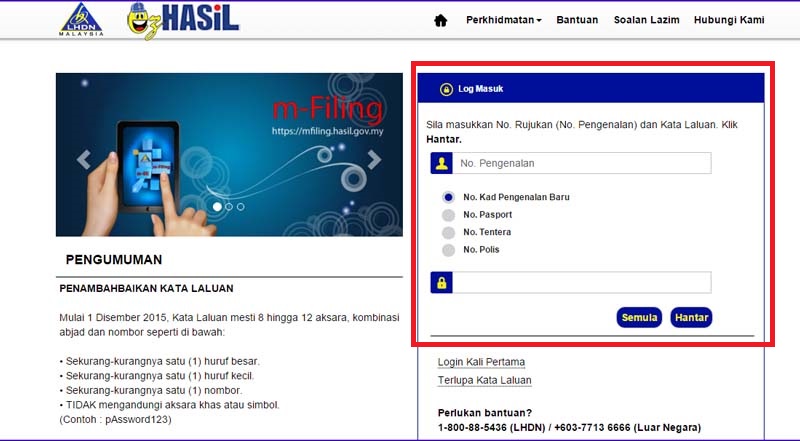

- Search for e Filing lhdn income tax 2022 Website.

Register for new account or Proceed to Login page.

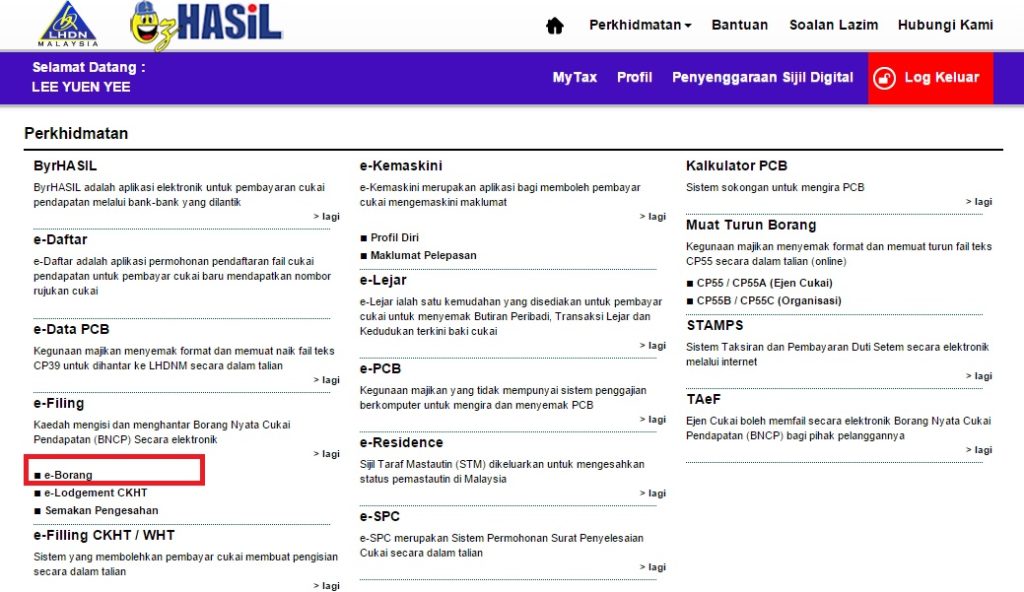

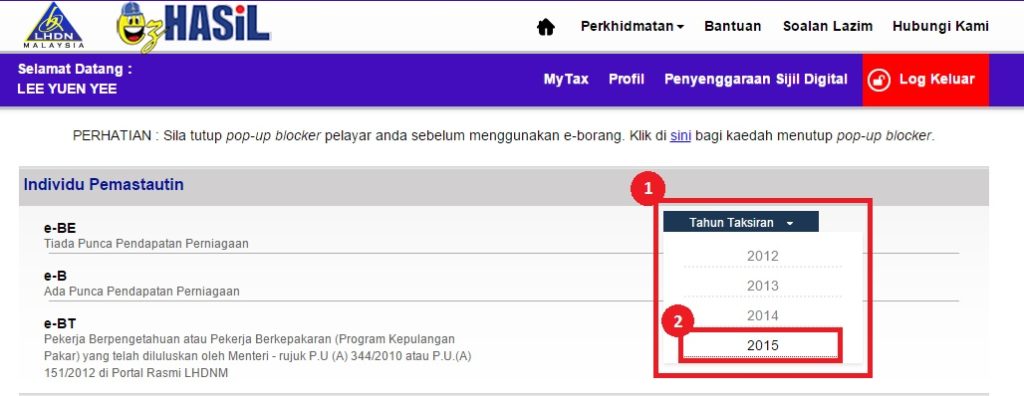

- Go to E borang for e filing malaysia

Click on e-Borang which will take you to tax e filing lhdn forms.

- Choose the Right e filing lhdn forms

Choose your corresponding e filing lhdn form and choose the assessment year (tahun taksiran).

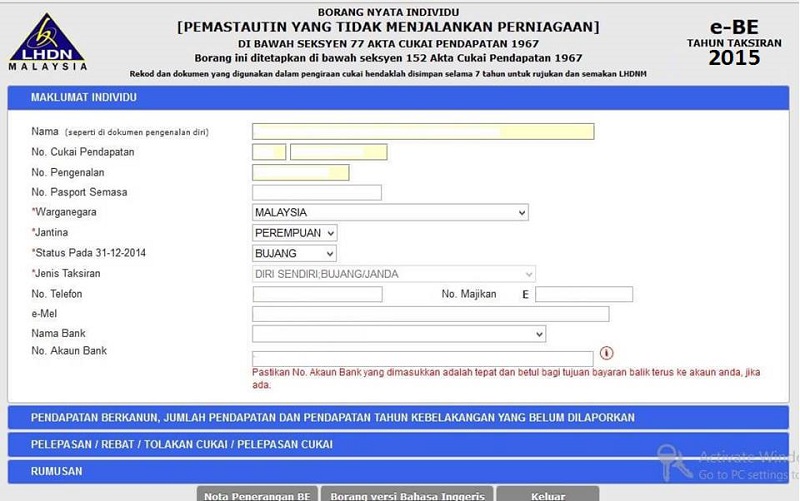

- Verified Your Personal Details for income tax 2022.

The selected form will display your basic individual details by default. Check whether all information is correct. If not, change the details to the current and latest information.

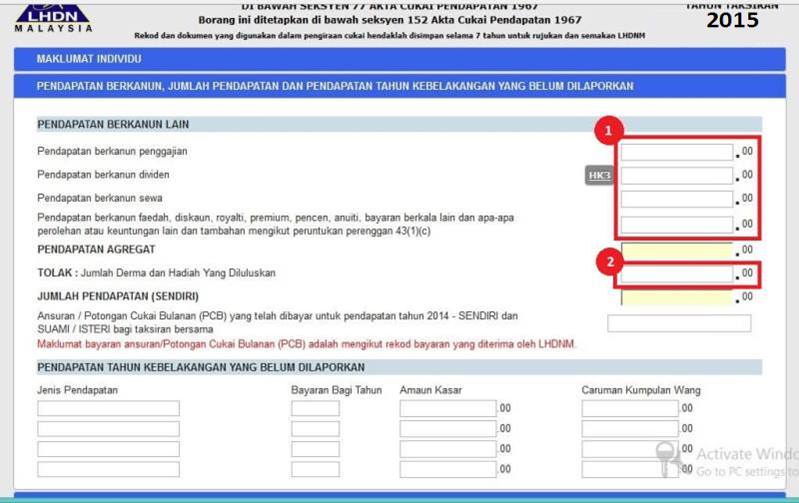

- Declare Your Income tax 2022.

In this section, you can key in your income tax 2022 details according to the relevant categories.

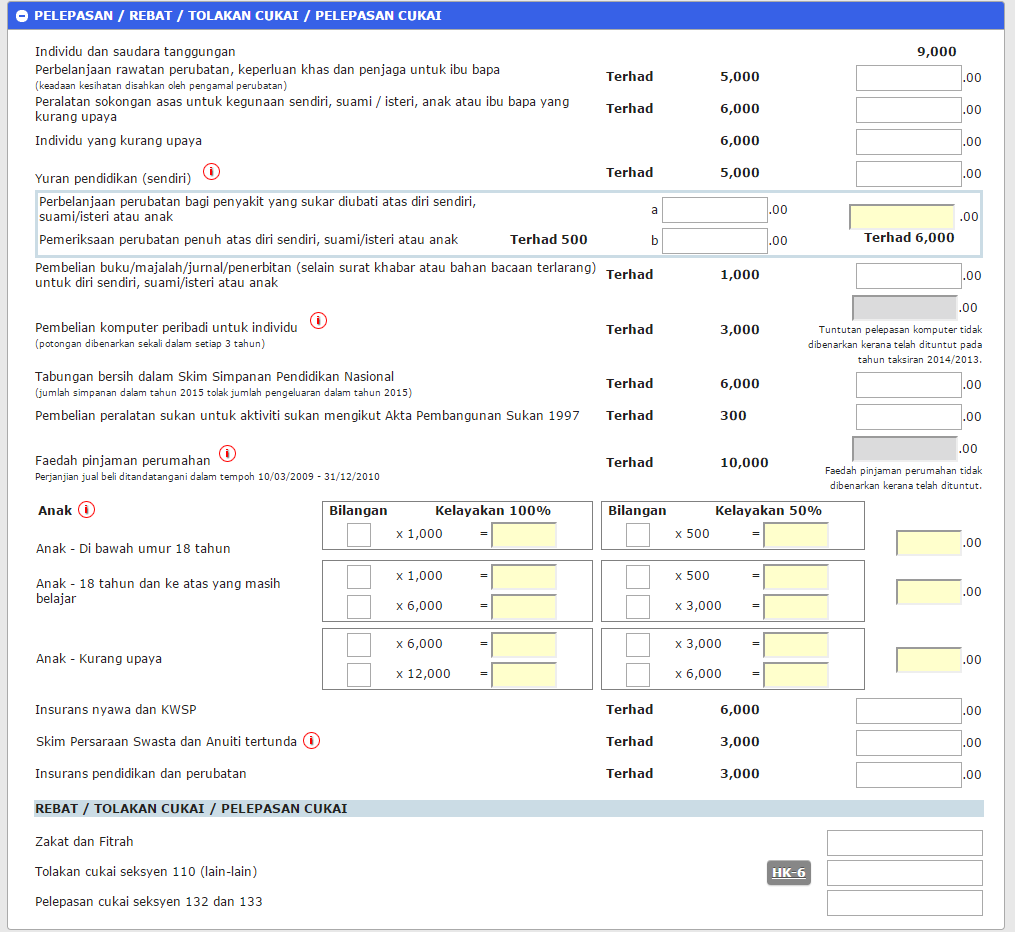

- Fill more info regarding e filing malaysia.

In this section, key in your tax reliefs, tax rebates and tax exemptions. Understand the tax reliefs available and identify which are applicable to you to ensure you spend wisely and save on your e filing malaysia. You need to save any proof of purchase or spending for your claim for up to seven years.

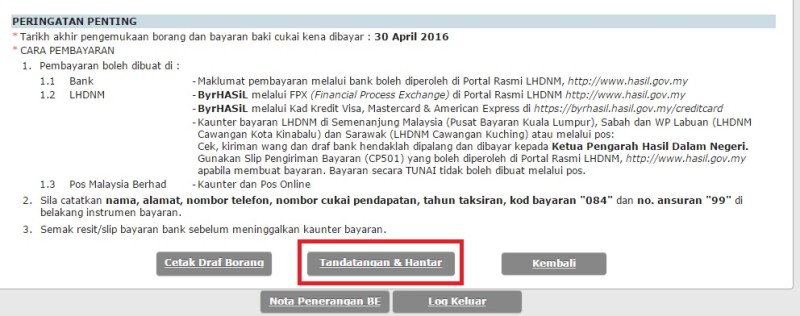

- Verified your total income tax 2022.

After you have filled up all the details in previous form, the system will automatically calculate your taxes and you would be able to know whether you have to pay more income tax 2022 or you have to receive a refund at this stage.

Contact Us For More Details on HR Software Malaysia

We specialized in smart systems such as HR Software Malaysia and Singapore, Time and Attendance Management System (TMS) which able to integrated with variety of Biometrics Devices including Fingerprint, facial and handpunch. We also provide latest BCA EPSS Biometrics Authentication System (BAS) for Singapore BCA ePSS Submission. Others system including, Access Control Solutions, Project Costing Solutions, HR Solutions, Worker Dormitory System, Hostel Billing Managment System, Visitor Management System (VMS), and Cloud based Time Attendance System for multi-chain solutions.

Smart Touch Technology Sdn Bhd

Address: 36-02 & 36-03, Jalan Permas 10, Bandar Baru Permas Jaya, 81750 Masai, Johor, Malaysia.

Contact Number: +607-388 9903

For More Details, please click HERE.

Package Price For HR Software Malaysia Solution

Smart Touch Technology “STT” is software, hardware & consultancy company. “STT” is specialized in the field of software development, system integration, implementation, systems support, and marketing of “STT” applications in one single database solution. “STT” has developed programs such as HR Software Malaysia, SmarTime (Time & Attendance Systems), Job Costing System, Leave Management System, ID Badges Card System, Security & Access Control System and Visitor Management System.

“STT” is involved in installing numerous systems in both Singapore & Malaysia. “STT” software applications come with standard or customized (according to customers’ specifiction) solutions. The objective of the software design is to offer a flexible user-friendly software that is easy to implement, modify and upgrade.

Click HERE for more Pricing Details >> Package Price