Payslip Malaysia Format For Payroll System Malaysia

Payslip malaysia format is a document which an employer provides to the employee as proof of salary according to payslip format in Malaysia. It contains all necessary the payslip format malaysia like the description of all income earned, exemptions, deductions and taxes cut from your salary.

Employers can share the payslip format with employees in paper or mail format. Both the type of payslips hold the same importance and validity.

However, most of us dispose a payslip format without giving it the due importance. Mainly, because all we want to know is the money we made and how much went to deductions of various types of payslip format Malaysia.

Importance of Payslip Malaysia Format According to Payroll System Malaysia

Manual and computerized payslip malaysia format is valid proof of document. Modifying an issued payslip is considered a criminal offense. So an employer has to ensure that employees will not be able to modify the payslip. For this purpose, payslip are generally given in PDF format.

- It acts as an important legal proof of employment

- You can avail loans, mortgage or other borrowings with the help of Payslip as it assures that their lending will be repaid.

- It is an important proof of income which helps you file income tax returns.

- Having a valid payslip helps you to access to various facilities provided by the government like medical care etc.,

- It helps in negotiating salary with new employers for better pay

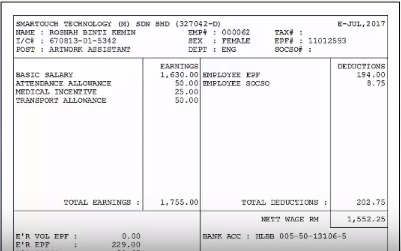

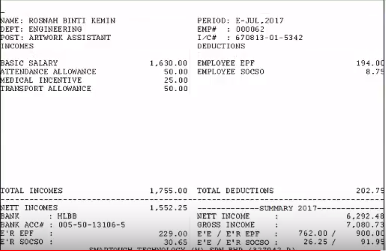

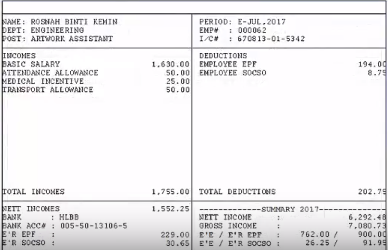

Payslip Malaysia Format Component that Suits Payroll System Malaysia

Payslip Malaysia Format : Income

All the income, gains are located on the left side of the payslip malaysia format. Let us take a look at the different types of income below.

- Basic Salary

This is the basic and main component of income. The percentage of Basic differs from company to company. It is the basis for the calculation of various other components of the payslip. Basic is fully taxable.

- Dearness Allowance (DA)

Dearness Allowance should neither be high nor low. It is paid to reduce the impact of inflation on the employee. In some companies, DA is an optional head of salary.

- House Rent Allowance (HRA)

It is an allowance to pay out the house rent of the employees. Employees can claim exemption on this by submitting rent receipts

- Conveyance Allowance

It is an allowance for an employee to cover his / her expenses of travel from home to work and work to home.

- Other Allowances

There can be various other allowances according to the company policies. These can be uniform allowance, special allowance, city conveyance allowance, child education allowance etc.

- Reimbursement

Reimbursement can also be shown as income in the payslip of the employee. Reimbursements for fuel, medical and food coupon will come under this head.

Payslip Malaysia Format : Deduction

All the deductions are located on the right side of the Payslip Malaysia Format. Deductions can be statutory or based on company policy.

- Provident Fund (PF) – Statutory

It provides retirement benefits or savings to the employee. PF is calculated on (Basic+DA). Only employee contribution of 12% on (Basic+DA) can be seen in the payslip of the employee.

- Employees’ State Insurance (ESI) – Statutory

It provides medical facility to all eligible employees. The deduction towards ESI compulsory. Employee contributes 1.75% on gross salary.

- Professional Tax (PT) – Statutory

It is a tax collected by the state government from all salaried employees. PT depends on state to state government. It is calculated on the gross earnings of the employee. Gross earnings are the sum of all income.

- Tax Deducted at Source (TDS) – Statutory

The amount of tax deducted by the employer on behalf of the Income Tax Department from the salary of the employee.

Types of Payslip Malaysia Format

This is a simple payslip malaysia format you may use for your purposes. If you are small business owners where you are running your business with a small number of employees, you might find this useful since you can modify it to meet your own needs.

Payslip Malaysia must have a well professionally designed format with all features and details. Actually, this format had made in an easy to everyone for customization for individual use.

Now days, many companies are using payroll system which made by auto application / software generate and sending each employee on its email. But for small scale industry, it can be costly and unusual if make financial burden. Hence formatted Payslip is best option in this regards.

How to Get Payslip Malaysia Format

Please fill up the form and email to us if you have any question and interest with our Payslip Malaysia Format

Contact Us For More Detail About Payslip Malaysia Format

We specialized in smart system such as Payroll for both Singapore and Malaysia, Time and Attendance Management System (TMS) which able to integrated with variety of Biometric Devices including Fingerprint, facial and handpunch. We also provide latest BCA EPSS Biometric Authentication System (BAS) for Singapore BCA ePss Submission. Other system including, Access Control Solutions, Project Costing Solutions, HR Solution, Worker Dormitory System, Hostel Billing Management System (VMS), and Cloud based Time Attendance System for multi-chain solutions

Smart Touch Technology Sdn Bhd

Address: 36-02 & 36-03, Jalan Permas 10, Bandar Baru Permas Jaya, 81750 Masai, Johor, Malaysia

Contact Number : +607-3889903

For More Detail, please click HERE