How to do PCB Calculator through Payroll System Malaysia?

PCB Calculator is a personal income tax system in which the tax deduction rate increases as an individual’s income increases based on Malaysia Payroll System.

PCB Calculator stands for Potong Cukai Berjadual in Malaysia Payroll System. This PCB Calculator also popularly known as monthly tax deduction among many Malaysians.

In general, as a Malaysian has a responsibility to contribute government’s revenue.

Therefore, Malaysia government had introduced a simple and a very friendly of tax deduction from monthly payroll salary which is PCB Calculator required by Lembaga Hasil Dalam Negeri (LHDN), Malaysia.

How To Get PCB Calculation Malaysia?

In year 2022, Malaysia’s government has announced amendment of specification for PCB calculator using computerised calculation method, which proposed in the Budget 2022 for Malaysia Payroll System

- Review for Income Tax Relief on Contribution to an Approved Provident Fund or Takaful or Life Insurance Premium.

- Individual Income Tax Relief on Net Annual Savings in The National Education Savings Scheme.

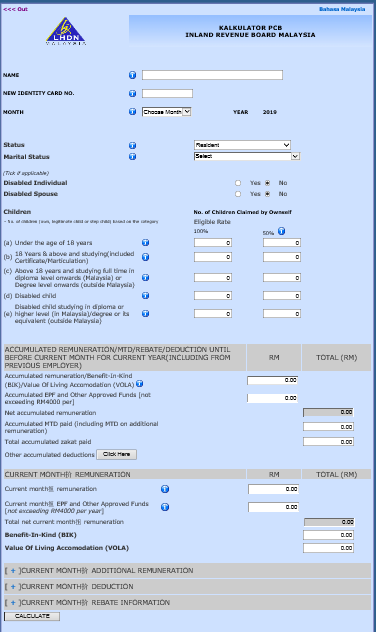

The PCB Calculator as known as Inland Revenue Board Malaysia (IRBM), which an accurate system to calculate individual tax deduction developed by LHDN.

Salary Deduction for PCB Calculator

Individual’s tax deduction for pcb calculator covers all basic tax relieves such as individual status, spouse, Employees Provident Fund (EPF) contribution and child relief. Individual status and spouse have categorized as single, married but spouse is not working and married but spouse is working.

Under the age of 18 years.

- Eligible child deduction RM2,000.00 each

18 years & above and studying (include Certified/Matriculation).

- Eligible child deduction RM2,000.00 each

Above 18 years and studying full time in diploma level onwards (Malaysia) or Degree level onwards (outside Malaysia).

- Eligible child deduction RM8,000.00 each

Disabled child.

- Eligible child deduction RM6,000.00 each

Disabled child studying in diploma or higher level (in Malaysia)/degree or its equivalent (outside Malaysia).

- Eligible child deduction RM14,000.00 each

Am I taxable and what should do if taxable for PCB Calculator?

With effective year 2015 an individual who earns an annual employment income of RM34,000 after Employee’s Provident Fund (EPF deduction) has to register to tax file. The application to register an income tax reference number can be made at LHDN branch. Document required for registration:

- A copy of the latest Salary Statement (EA/EC form) or latest Salary slip.

- A copy of Identification card (IC)/police IC/army IC/international passport.

- A copy of marriage certificate (if applicable).

Taxpayer’s Responsibilities for PCB Payroll Malaysia

Tax Payers are responsible for record keeping and required to keep for seven (7) years from the end of the year. LHDN has the right to request any supporting documents for taxes paid previously.

- EA/EC Form

- Original dividend vouchers

- Insurance premium receipts

- Books purchase receipts

- Medical receipts

- Other supporting documents.

A tax deduction is similar to a tax relief where it reduces chargeable income. Tax deduction are result of Gifts and Donations. Donations are only tax deductible if they are made to a Government approved charitable organisation or directly to the Government and must keep the receipt of the donation.

What is The Types Of Tax Payment?

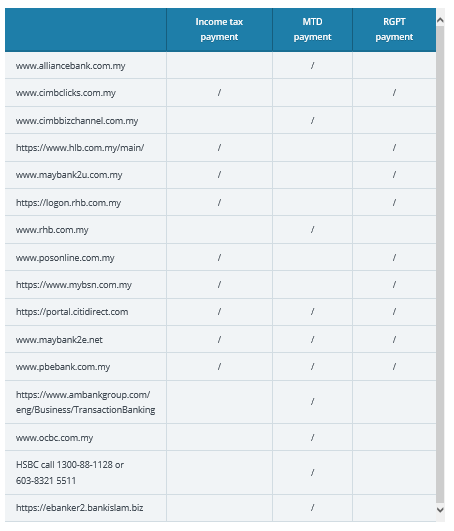

Here are the many ways to pay personal income tax:

Pay income tax via FPX Services for pcb calculator

Financial Process Exchange (FPX) gateway allows you to pay your income tax online. You need an Internet Banking account with the FPX participating bank as follows:

Affin Bank & Affin Islamic Bank

Alliance Bank & Alliance Islamic Bank

Bank Islam

Bank Rakyat

CIMB Bank & CIMB Islamic Bank

Hong Leong Bank & Hong Leong Islamic Bank

HSBC & HSBC Amanah

Maybank & Maybank Islamic Bank

RHB & RHB Islamic Bank

UOB Bank

Bank Muamalat

Bank Simpanan Nasional

Deutsche Bank

Kuwait Finance House

Standard Chartered & Standard Chartered Saadiq

OCBC Bank.

To make the payment, please go to ByrHASiL at https://byrhasil.hasil.gov.my/

Pay Income Tax Via Credit Card for pcb calculator

All VISA, Mastercard and American Express credit card issued in Malaysia can be used for this service.

PayIncome Tax Via LHDN Agents for pcb calculator

Several methods can be chosen as below:

Pay tax over the counter at bank branches.

CIMB Bank

Public Bank

Maybank

POS Malaysia

Affin Bank

Bank Rakyat

RHB Bank

Bank Simpanan Nasional

2. Pay income tax through online

Pay tax at the ATM

i. Public Bank Berhad

ii. Maybank Berhad

iii. CIMB Bank Berhad

Pay tax via tele-banking

Maybank Berhad only

Payment via Cheques Deposit Machine (CDM)

Payment via Cash Deposit Machine (CAM)

i. CIMB Bank Berhad

ii. Public Bank Berhad

Contact Us For More Details on HR Software Malaysia Solution with PCB Calculator

We specialized in smart systems such as HR Software Malaysia and Singapore, Time and Attendance Management System (TMS) which able to integrated with variety of Biometrics Devices including Fingerprint, facial and handpunch. We also provide latest BCA EPSS Biometrics Authentication System (BAS) for Singapore BCA ePSS Submission. Others system including, Access Control Solutions, Project Costing Solutions, HR Solutions, Worker Dormitory System, Hostel Billing Managment System, Visitor Management System (VMS), and Cloud based Time Attendance System for multi-chain solutions.

Smart Touch Technology Sdn Bhd

Address: 36-02 & 36-03, Jalan Permas 10, Bandar Baru Permas Jaya, 81750 Masai, Johor, Malaysia.

Contact Number: +607-388 9903

For More Details, please click HERE.

Package Price For HR Software Malaysia Solution with PCB Calculator

Smart Touch Technology “STT” is software, hardware & consultancy company. “STT” is specialized in the field of software development, system integration, implementation, systems support, and marketing of “STT” applications in one single database solution. “STT” has developed programs such as HR Software Malaysia, SmarTime (Time & Attendance Systems), Job Costing System, Leave Management System, ID Badges Card System, Security & Access Control System and Visitor Management System.

“STT” is involved in installing numerous systems in both Singapore & Malaysia. “STT” software applications come with standard or customized (according to customers’ specifiction) solutions. The objective of the software design is to offer a flexible user-friendly software that is easy to implement, modify and upgrade.

Click HERE for more Pricing Details >> Package Price