Socso Table 2022 for Payroll Malaysia

SOCSO Table 2022 Malaysia (Social Security Organization), also known as PERKESO (Pertubuhan Keselamatan Sosial), is a Malaysian government agency that was established on 1 January 1971 to provide social security protections to Malaysian employees under the Employees’ Social Security Act, 1969 as a government department of the Ministry of Labour and Manpower.

Socso Table 2022 Directory

√ Socso Table 2022 Contribution

√ Wages Not For Socso Table 2022

√ Socso Table 2022 Contribution Rate

√ How To Pay For Socso Table 2022

√ Benefit Claims for Socso Table 2022

√ Socso Table 2022 For Foreign Workers

√ Implementation Of Socso Table 2022

√ Socso Branch For Socso Table 2022

√ More Info For Sosco Table 2022

1. What is Socso contribution For Socso Table 2022?

Company is required to contribute SOCSO Malaysia for its staff/workers according to the SOCSO Table 2022 & Rates as determined by the Act.

Both socso table 2022 and rates of contribution based on the total monthly wages paid to the employee and contributions should be made from the first month the employee is employed.

- First Category: Employment Injury and Invalidity Schemes

- Employees who are less than 60 years of age, contributions payable by employers and employees are for the Employment Injury Scheme and the Invalidity Scheme.

- Rate of contribution under this category comprises 1.75% of employer’s share and 0.5% of employees’ monthly wages according to the contribution schedule

- Second Category: Employment Injury Scheme Only

- Employees who 60 years old and above and still working

- New employees who are 55 years of age, they must be covered under the Second Category.

- Insured Person receiving Invalidity Pension and still working and receiving less than 1/3 of the average monthly wages before the invalidity

- Rate of contribution under this category is 1.25% of employees’ monthly wages, payable by the employer, based on the contribution schedule

Wages subject to SOCSO Table 2022 contribution:

Not all wages payments to staff/workers are subject to SOCSO Table 2022 contribution and there are certain wages excluded from SOCSO contribution. All remuneration or wages stated below and payable to staff/workers are subject to SOCSO table 2022 contributions

- Salary / Wages (full/part time, monthly/hourly)

- Overtime payments

- Commission

- Paid leave (annual, sick and maternity leave, rest day, public holidays)

- Allowances

- Service Charge

Wages NOT subject to SOCSO Table 2022 contribution:

The following wages or remuneration payable to staff/workers are NOT subject to SOCSO table 2022 contribution:

- Payments by employer to any pension or provident fund for employees

- Mileage claims

- Gratuity payment(s) for dismissal or retrenchments

- Annual bonus

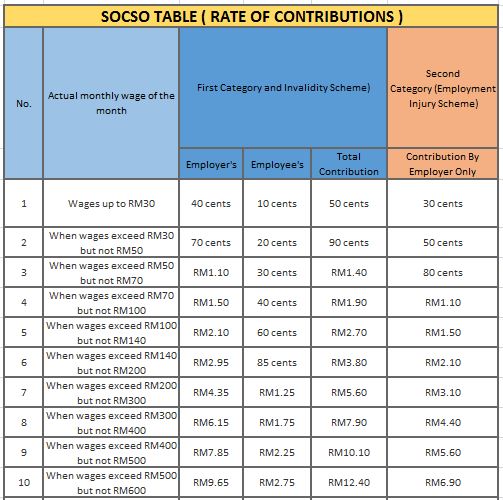

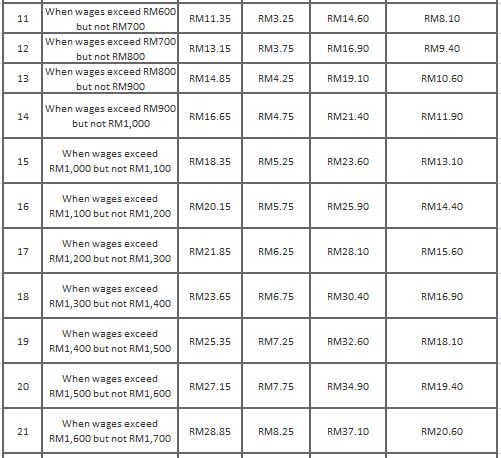

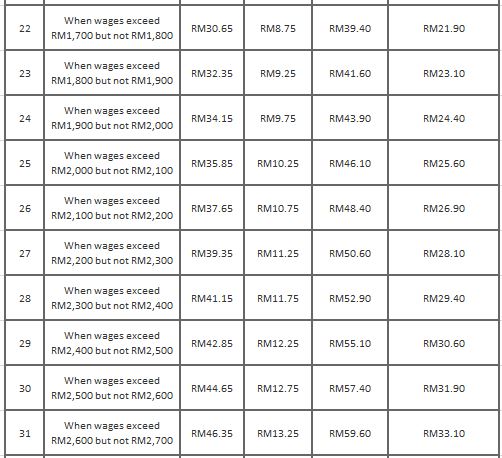

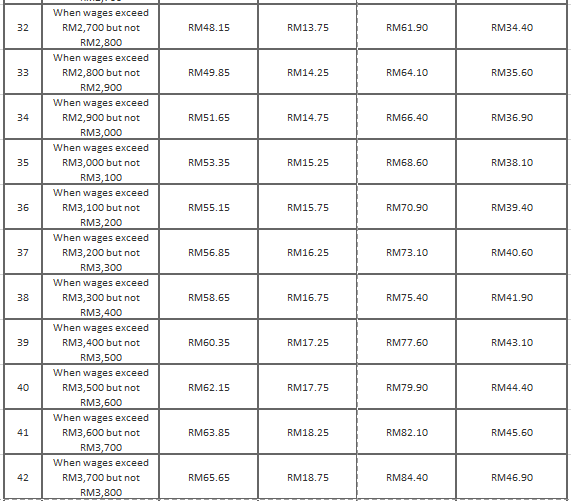

Rate Of Contribution ( Socso Table 2022)

2. When & How to Pay SOCSO Table 2022 Malaysia?

Every company is required to contribute SOCSO table 2022 Malaysia for its employees, irrespective they are full/part time, permanent or temporary, employment or contract. Every company is required to remit the contribution sum to PERKESO Office .Contributions payable for any month must be paid no later than the 15th day of each succeeding month.

PERKESO ASSIST Portal For Socso Table 2022

- Employers need to register to obtain the ID for the ASSIST Portal by filling in the form for PERKESO ASSIST Portal ID.

- Employers can download the form from SOCSO Table 2022 Malaysia website and sent it to the nearest SOCSO Office.

- PERKESO ASSIST Portal can be accessed by login to ASSIST iPERKESO Portal and by visiting www.perkeso.gov.my

PERKESO ASSIST Portal For Socso Table 2022

visit www.perkeso.gov.my and login to iPERKESO

Internet Banking For Socso Table 2022 Malaysia

Employer must be registered and has an account at any of the following banks:

- Malayan Banking Berhad

- CIMB Bank Berhad

- RHB Bank Berhad

- Public Bank Berhad

- Hong Leong Bank

- Affin Islamic Bank

- HSBC Bank

- Ambank

- Alliance Bank

- Citybank

- Bank Islam

- OCBC

Counters at SOCSO Table 2022 Malaysia offices

Using ACR reference with contribution data submitted through PERKESO ASSIST Portal – made using cheque or money/postal order online.

Banks appointed by SOCSO Table 2022 Malaysia

As collection agents for contribution payments are as follows:

i. Maybank Berhad ii. RHB Bank Berhad iii. Public Bank Berhad (starting 1 March 2018)

3. Coverage of the EIS (Employment Insurance System) Act 2017 in Socso Table 2022

The Employment Insurance System Act 2017 was introduced and came into force on 1 January 2018.

All employers in the private sector are required to pay monthly contributions on behalf of each employee. (Government employees, domestic workers and the self-employed are exempt)

An employee is defined as a person who is employed for wages under a contract of service or apprenticeship with an employer in Socso Table 2022. The contract of service or apprenticeship may be expressed or implied and may be oral or in writing.

All employees aged 18 to 60 are required to contribute. However, employees aged 57 and above who have no prior contributions before the age of 57 are exempt. Contribution rates are capped at an assumed monthly salary of RM4000.00

Contribution Rate of EIS for Socso Table 2022 Malaysia

Contribution rates are set out in the Second Schedule and subject to the rules in Section 18 of the Employment Insurance System Act 2017. Employers in the private sector are required to pay monthly contributions on behalf of each employee. (Government employees, domestic workers and the self-employed are exempt)

4. Eligibility to Claim Benefit in Socso Table 2022 Malaysia

All employees insured under the Act (known as Insured Persons) for Socso Table 2022 who have lost their employment are eligible with the following exceptions:

- Voluntary resignation by the Insured Person

- Expiry of the Insured Person’s fixed-term contract

- Unconditional termination of a contract of service based on an agreement between the Insured Person and his/her employer

- Completion of a project specified in a contract of service

- Retirement of the Insured Person

- Dismissal due to misconduct by the Insured Person

Applicants for benefits must prove that they are able to work, available to work and actively seeking work.

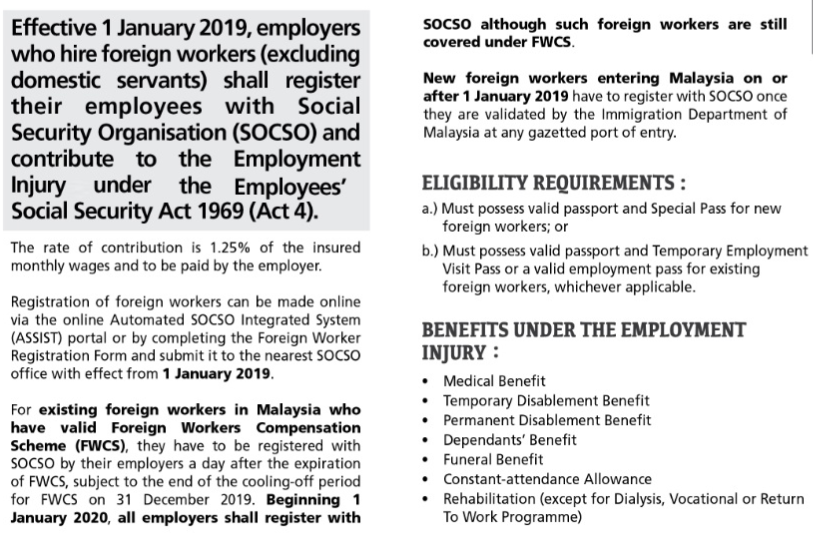

5. Social Protection for Foreign Worker in Socso Table 2022 Malaysia

Transfer of Foreign Worker’s Coverage from the Foreign Workers Compensation Scheme (FWCS), the Department Of Labour to SOCSO Table 2022 Employment Injury Scheme

With effect from 1 January 2019, SOCSO table 2022 will take over the compensation for foreign workers according to the provision under the Employees’ Social Security Act 1969 (Act 4) covering the Employment Injury Scheme only.

Effective date of implementation of Socso Table 2022 Malaysia

All foreign workers with valid insurance coverage under the Foreign Workers Compensation Scheme (FWCS), the Department of Labour Peninsular Malaysia (JTKSM), Sabah and Sarawak will continue to be covered under the FWCS until the expiry date in 2022.

- The coverage of SOCSO Table 2022 Employment Injury Scheme will only take effect after the expiry of FWCS coverage.

- If the maturity date of FWCS extends beyond Socso Table 2022, the Employment Injury Scheme will automatically apply to all employers who employ foreign workers starting from 1 January 2020.

- For new foreign workers working in Malaysia beginning on the 1 January 2022, employers must directly register them with SOCSO table 2022 under the Employment Injury Scheme

Application of Socso Table 2022 Malaysia

Registration procedures, submission of contribution records, payment of contribution and processing of benefit claims for foreign workers and their dependents are similar to the existing process for Malaysian citizens and permanent resident workers under Act 4.

a) Foreign Workers Registration

- Employers must register their foreign workers via ASSIST portal or complete the Foreign Worker Registration Form as in Attachment A and submit it to the nearest SOCSO office.

- Foreign workers are eligible to be registered with SOCSO if they possess valid working permits or equivalent documents issued by the Immigration Department of Malaysia.

- Employers must submit supporting documents such as a photocopy of the front page of the passport containing employee details, valid working permit or entry permit or equivalent documents for SOCSO Table 2022 use.

- All foreign workers must register to obtain the Foreign Worker Social Security No. (12-digit KSPA No.), which is compulsory for the submission of employee contribution record.

- The 12-digit KSPA NO. must be referred to when dealing with SOCSO Table 2022 on all matters related to foreign workers despite any subsequent changes to the worker’s passport details, valid working permit or equivalent document in the future.

b) Submission of Foreign Worker Contribution

- Employers must make contribution payment based on the Second Category for the Employment Injury Scheme under Act 4, which is for the employer’s share only as in Attachment B.

- All foreign worker contribution payments must be made online through the ASSIST Portal or internet banking by using KSPA No.

c) Claims

- All foreign workers benefit claims must submit a complete Foreign Worker Claim Notification Form as in Attachment C, together with supporting documents, and not using the existing Form 34.

- Foreign workers are not eligible to claim for education loan benefit, vocational rehabilitation, dialysis treatment that is not under the Employment Injury Scheme, and Return to Work programme.

- Foreign workers who die in Malaysia due to employment injury and are buried in their country of origin, are eligible for RM6500 in Funeral Benefit.

- Other than the situation above, Funeral Benefit under the Employment Injury Scheme will be RM2000 and is paid to eligible dependents. If there are no dependents, the amount of Funeral Benefit will be based on the amount stated in the funeral receipt, or whichever is lower

Socso Table 2022 Branch in Johor

SOCSO Johor State Wisma PERKESO, No. 26, Jalan Susur 5 Off Jalan Tun Abdul Razak, Larkin 80200 Johor Bahru, Johor | |

Tel Fax | : 07 – 225 6600 / 6601 : 07 – 223 3180 / 07 – 223 3190 |

Email | : pksjbahru |

SOCSO Muar Office No. 34 & 35 Taman Tun Dr. Ismail Jalan Bakri, 84000 Muar, Johor | |

Tel Fax | : 06 – 954 2771 / 2164 : 06 – 954 2254 |

Email | : pksmuar |

SOCSO Batu Pahat Office No. 16 & 17, Jalan Setia Jaya, Taman Setia Jaya 83000 Batu Pahat, Johor | |

Tel Fax | : 07 – 433 1333 : 07 – 432 2724 / 07 – 431 3009 |

Email | : pksbpahat |

Contact Us For More Details on Payroll Solution with Socso Table 2022

We specialized in smart systems such as Payroll for both Singapore and Malaysia, Time and Attendance Management System (TMS) which able to integrated with variety of Biometrics Devices including Fingerprint, facial and handpunch. We also provide latest BCA EPSS Biometrics Authentication System (BAS) for Singapore BCA ePSS Submission. Others system including, Access Control Solutions, Project Costing Solutions, HR Solutions, Worker Dormitory System, Hostel Billing Managment System, Visitor Management System (VMS), and Cloud based Time Attendance System for multi-chain solutions.

Smart Touch Technology Sdn Bhd

Address: 36-02 & 36-03, Jalan Permas 10, Bandar Baru Permas Jaya, 81750 Masai, Johor, Malaysia.

Contact Number: +607-388 9903

For More Details, please click HERE.

Package Price For Payroll Solution With Socso Table 2022

Smart Touch Technology “STT” is software, hardware & consultancy company. “STT” is specialized in the field of software development, system integration, implementation, systems support, and marketing of “STT” applications in one single database solution. “STT” has developed programs such as SmarTime (Time & Attendance Systems), Job Costing System, Leave Management System, ID Badges Card System, Security & Access Control System and Visitor Management System.

“STT” is involved in installing numerous systems in both Singapore & Malaysia. “STT” software applications come with standard or customized (according to customers’ specifiction) solutions. The objective of the software design is to offer a flexible user-friendly software that is easy to implement, modify and upgrade.

Click HERE for more Pricing Details >> Package Price