Employee EPF Contribution Rate Malaysia will be reduces in 2022

Malaysia’s Employees Provident Fund, Kuala Lumpur will extend reductions in employees statutory contribution rate through 2022 to help its more than 14 million participants cope with the coronavirus fallout. A reduction in EPF Contribution Rate was introduced this year at the height of the global economic uncertainty resulting from the COVID-19 pandemic.

The announcement is in less than two weeks allowing members in the nationwide defined EPF Contribution Rate plan, the backbone of Malaysia’s retirement system, to tap their retirement savings as a means of getting through COVID-19-related economic turbulence.

New EPF Contribution Rate in Year 2022

According to the government, the reduced contribution rate by 2% is expected to free up potential cash flow of up to RM9.3 billion. This will enable members to enjoy a slightly higher take home pay as their salary deduction for EPF is reduced.

To recap, the current reduced contribution rate of 11% to 7% which started on 1st April will end on the 31st December 2020. If you’ve submitted the KWSP 17A (Khas 2020) form previously, you’ll need to submit a new form again for 2022.

The automatic reduction for the contribution rate will only affect members who are aged below 60 years old. Members aged 60 years old and above will remain at the existing rate.

Take note that the employer’s contribution remains unchanged and the rate reduction only applies to employee’s salary deduction for EPF. For members who self contribute, EPF says the new statutory rate does not apply and it is still subject to a maximum of RM60,000 per year.

How to apply to maintain 11% rate in 2022?

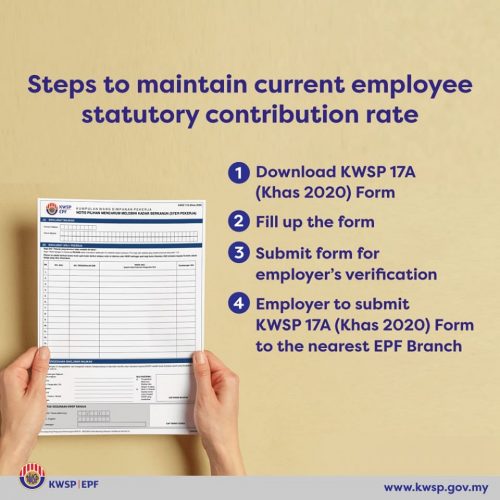

If you don’t need the extra cash and would prefer to save more for your future retirement fund, you can choose to opt-out by submitting a form. Here’s what you need to do:

- Download the Borang KWSP 17A (Khas 2022) form.

- Borang KWSP 17A (Khas 2022) must be filled up by employees who wish to maintain the 11% rate. For convenience, all employees in a company can fill up a single excel form.

- Employers are required to enter the employee’s application online via i-Akaun (Employer). Employers are only allowed to key in starting 14th December 2020.

- Employers must keep the completed Borang KWSP 17A (Khas 2022) form as record.