How to do Payroll Calculator with PCB calculator via Payroll Software Malaysia

Payroll Calculator can be define with a lot of meaning depending on the level on understanding of each person. Some person may refer payroll malaysia with pcb calculator, socso table 2022 and epf contribution table as the amount pay during each pay period or the process of actually calculating and distributing wages and taxes.

No matter what kinds of meaning will be describe by any person, the main reason of payroll calculator will surely about pay be received by the employer per month. Each salary received by the employer will be calculated depends on what be agreed and follow Malaysia Labour Law.

Each of the employee must be alert with all rules and regulation stated in Malaysia Labour Law in order to hire and to pay an employer. All the salary must follow Payroll Calculator Rules in order to avoid any of unexpected events occurs between employee and employer.

Types of Worker According To Payroll Calculator Malaysia

Full-Time Workers

Employment in which a person works a minimum number of hours defined as such by their employer in Payroll Calculator Malaysia. Full-time employment for payroll calculator malaysia often comes with benefits that are not typically offered to part-time, temporary, or flexible workers, such as annual leave, sick leave, and health insurance.

Part-Time Workers

Employment that carries fewer hours per week than a full-time job for payroll calculator malaysia. The normal hours of work of a part-time employee shall be seventy percent of the normal hours of work of such full-time employee.

They have the same rights as full-time employees.

Contract Workers

Employee who works under contract for an employer. A contract employee is hired for a specific job at a specific rate of pay in payroll calculator malaysia. A contract employee does not become a regular addition to the staff and is not considered a permanent employee.

Freelancers

Employee who works on different projects with different companies instead of being a company.

Types of Compensation According to Payroll Calculator Malaysia

Basic Salary

Basic salary is the amount paid to an employee before any extras are added or taken off, such as reductions because of salary sacrifice schemes or an increase due to overtime or a bonus in payroll calculator malaysia.

Part Month

A basic salary is usually set as an amount of money paid on a monthly basis.

Calendar Days

Count the number of days in the month.

Working days

Calculated as number of working days (including public holidays. Referring to working shift pattern.

Unpaid Leave

If the employee takes unpaid leave then an amount equivalent. Leave should be deducted from the gross salary. Depending of working pattern.

Based on a fixed minimum number of hours as defined in the employee’s contract of employment for payroll calculator malaysia. After normal hours of work, the extra hours called as .

• Overtime pay is 1.5 x hourly rate of pay for normal workdays. |

• Overtime pay is 2.0 x hourly rate of pay for rest days. |

• Overtime pay is 3.0 x hourly rate of pay for public holidays. |

Hourly rate can be calculated as follows:

E.g.: gross monthly salary +any allowance subject OT / 26 days (minimum hourly rate according to the Employment Act for payroll calculator malaysia but employers can pay a more) / hours of work per day x1.5/2.0/3.0.

Incentive Pay

Incentives are performance-related payments and include:

Bonuses usually paid quarterly or annually (based on company profit on payroll calculator) |

Commission usually paid monthly and depends on sales |

Gratuity (or tip) paid to service workers |

Payments dependent on company profitability (can also consist in share) |

Incentive cash payments will be included in the employee’s payslips to make up total gross pay. |

Perquisites and Benefit in Kinds (BIK) in payroll calculator malaysia

Perquisites | Benefit in Kinds |

Benefits in cash or in kind which are convertible into money | Not convertible into money. |

Examples include gift vouchers, petrol allowance, driver employed by the employee but paid for by the employer, professional subscriptions | Example includes company car, driver or phone provided by the employer, medical benefit. |

Allowances

A type of perquisite which are usually fixed monthly cash payments for specific purposes.

Allowances may be paid to cover certain expenses the employee incurs during the performance of his employment duties. Paying allowances removes the administrative burden on the employer and the employee of keeping a record of their expenses as is the case when employees are reimbursed business expenses based on the employee claiming actual expenses incurred for payroll calculator malaysia.

Value of Living Accommodation (VOLA)

VOLA is living accommodation provided for an employee by his employer. The value of the benefit is to be treated as gross income from employment of payroll calculator malaysia.

The general rule is that VOLA is calculated for payroll calculator as follows:

Whichever is lower

Defined value of the living accommodation (usually the market rent); OR

30% of the gross income from employment (including wages, allowances, perquisites but not benefit-in-kind and share options perquisite);Different rules apply to directors of controlled companies or employees living in specific accommodation like hotels or plantations.

Statutory Deduction & Employer Contribution in Payroll Calculator

PCB Calculator 2022 for Payroll Calculator.

PCB stands for “Potongan Cukai Berjadual”. They are monthly income tax deductions required by the Inland Revenue Board (LHDN).

Certain perquisites or BIKs received by an employee are exempt from PCB Calculator 2022 These are exemptions.

Certain payments made by an employee for particular purposes can be deducted from the taxable income of that employee. These are deductions.

Exemption of PCB Calculator 2022 For Payroll Calculator

Most compensation items are liable to PCB Calculator, but certain perquisites and BIKs are either fully or partially exempt:

Payroll Calculator Category | Example |

Allowance | – Travelling |

– Petrol | |

– Toll payment | |

* Exempt up to RM 6,000 per year if travel is for official duties; more than RM 6,000 if records are kept | |

Communication | – Mobile phone |

– Gift of fixed line telephone, pager, PDA | |

(Limited to 1 unit per category of asset) | |

– Monthly bills for subscription of broadband, telephone, mobile, pager and PDA | |

(limited to 1 line per category of asset) | |

Parking | – Parking rate and parking allowance |

Meal | – Meal allowance |

*restricted to the actual amount spent | |

Subsidiary (Interest of Loan) | – Housing |

– Education | |

– Car | |

*if the amount of loan does not exceed RM 300,000 | |

Childcare | – Exempt up to RM2,400 per year (children up to 12 years old) |

Perquisite | – In respect of certain awards (e.g., excellence, innovation, long service awards) – RM2,000 |

Deduction of PCB Calculator for Payroll Calculator

Certain deductions are available based on the employee’s marital status, number of children, or certain payments the employee made during the year and which can be claimed as a deduction up to certain limits. The amounts are deducted from taxable income to arrive at the employee’s chargeable income.

PCB Deduction | Amount |

Personal Tax Relief | RM9,000 |

Disabled Persons | RM6,000 |

Spouse has no income | RM4,000 |

Spouse is disabled | RM3,500 |

For each child under 18. Deduction can all be claimed by one parent (100%) or by both parents (50%). | RM2,000 |

Further deductions for children in higher education/ disabled children in higher education. | RM 8,000/RM 14,000 |

EPF contribution [up to RM 4,000] and life insurance [up to RM 3,000]. | RM7,000 |

SOCSO contribution table | RM250 |

Lifestyle relief | RM2,500 |

Either Medical or Carer expenses for parents included in Malaysia OR a personal deduction of RM 1,500 for each parent above 60 years old with an income not exceeding RM 24,000 per annum. | RM5,000 |

Basic supporting equipment for a disabled person (their spouse, parent) | RM6,000 |

Certain higher education fees for self. | RM7,000 |

Complete medical examination for the employee, spouse or child | RM500 |

Medical expenses for certain serious diseases for the employee, spouse or child. | RM6,000 |

Fees to childcare centres or kindergartens. | RM1,000 |

Breastfeeding equipment that can be claimed by women employees every 2 years. | RM1,000 |

Payment of alimony to former wife. | RM4,000 |

Education and medical insurance premiums. | RM3,000 |

CP38 Deduction of Payroll Calculator Malaysia

If an employee has tax arrears payable, LHDN may issue an instruction to their employer to deduct the tax in monthly installments for payroll calculator from the employee’s salary.

LHDN will indicate how much to deduct monthly and for how many months. This deduction eases the burden on the employee of having to pay the full tax arrears in one lump sum.

The amount of CP38 deduction is added to the PCB Calculator 2022 for the month and paid over by the employer to LHDN.

The amount of CP38 tax paid should not be added to the previous remuneration PCB Calculator in the following months for PCB calculation purposes since the PCB Calculator 2022 does not relate to the current year.

EPF Contribution Table 2022 for Payroll Calculator

Employees’ Provident Fund (Kumpulan Wang Simpanan Pekerja) commonly known by the acronym EPF (or KWSP) is a government agency under the Ministry of Finance. It manages the compulsory savings plan and retirement planning for private sector workers in Malaysia.

EPF contribution table 2022 is based on nationality and not residence status. EPF contribution table are mandatory for Malaysian citizens and permanent residents, while foreigners can choose whether willing to contribute or not.

There are both employer and employee for epf contributions table. The employee contribution is a deduction from gross pay on the employee’s payslip. The employer contribution will also usually appear on the payslips but is not deducted from the employee’s salary as it is the responsibility of the employer.

EPF Contribution Table 2022 for Payroll Calculator

Employee and employer for epf contribution table depend on the age of the employee for payroll calculator malaysia. For employees aged 60 to 75, the rate is 4% for employers and employees will not need to contribute anymore.

Normal minimum employee contributions are set at 11%. Employees can also choose to contribute more than the minimum contributions for payroll calculator malaysia. Employer contributions are set at 13% for employees whose salary subject to EPF is RM 5,000 or less, and 12% for employees with salaries above RM 5,000.

Foreigners who optional to contribute to EPF contribution table 2022 for payroll calculator have the same minimum monthly contributions as Malaysians, but their employers are only required to contribute RM 5 monthly, though they may optional to contribute more on payroll calculator malaysia.

Exempt Payments for EPF Contribution Table 2022

In general, all monetary payments that are meant to be wages are subject to EPF contribution table 2022 for payroll calculator malaysia, including;

- Salaries

- Payments for unutilised annual or medical leave

- Bonuses

- Allowances

- Commissions

- Incentives

- Arrears of wages

- Wages for maternity leave

- Wages for study leave

- Wages for half day leave

- Other contractual payments or otherwise

The following payments are not considered “wages” by the EPF and are not subject to EPF deduction for payroll calculator;

- Service charges (tips, etc)

- Overtime payments for payroll calculator (including payments for work carried out on rest days and public holidays)

- Gratuity (payment to employee payable at the end of a services period or upon voluntary resignation)

- Retirement benefits

- Termination benefits

- Travel allowances

- Payment in lieu of notice of termination of service (payment given when employee’s service is terminated)

- Director’s fee

- Gift (includes cash payments for holidays like Hari Raya, Christmas etc.)

- Benefits-in-kind and non-monetary perquisites

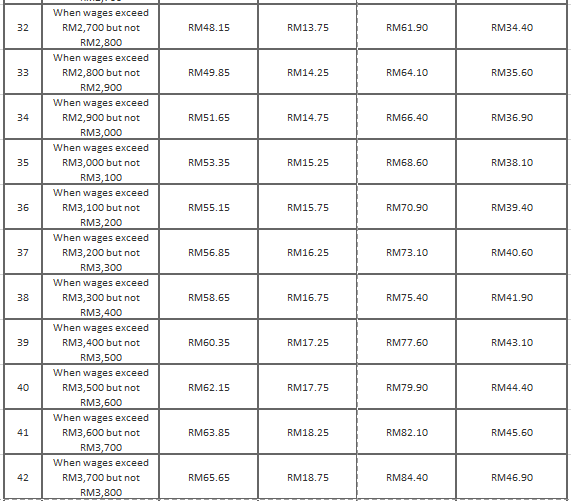

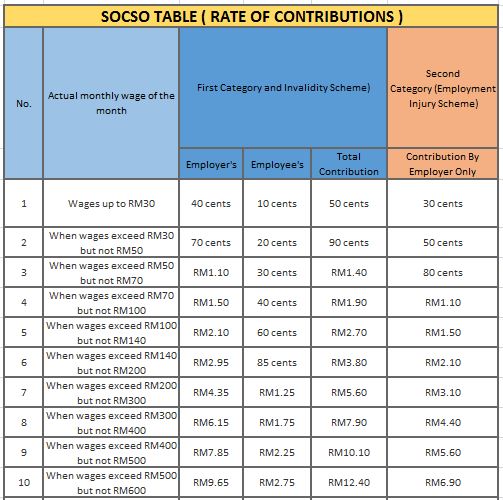

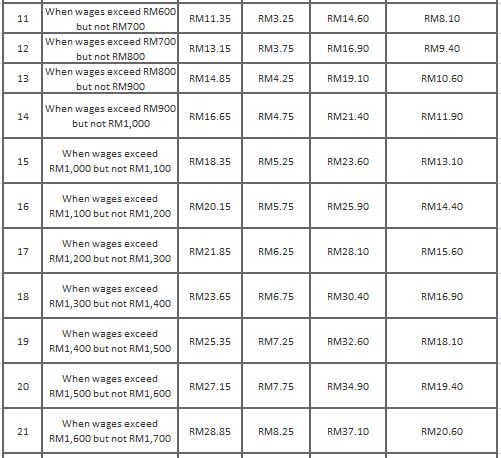

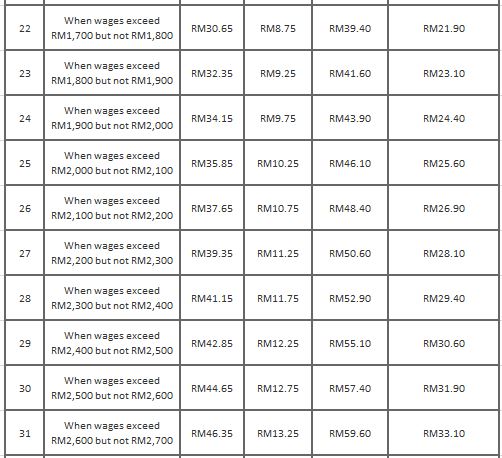

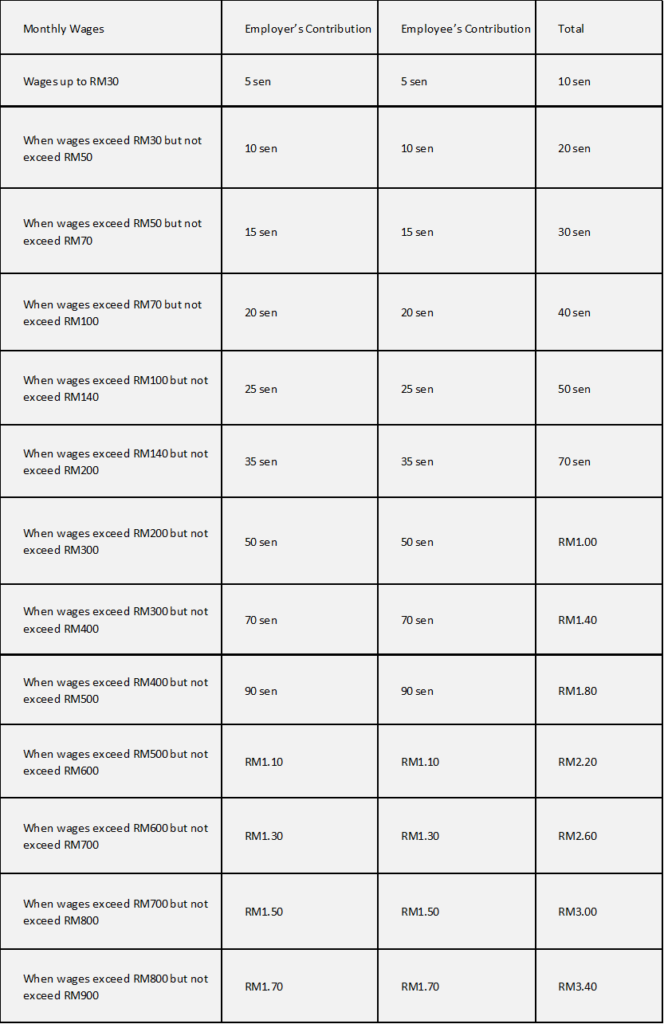

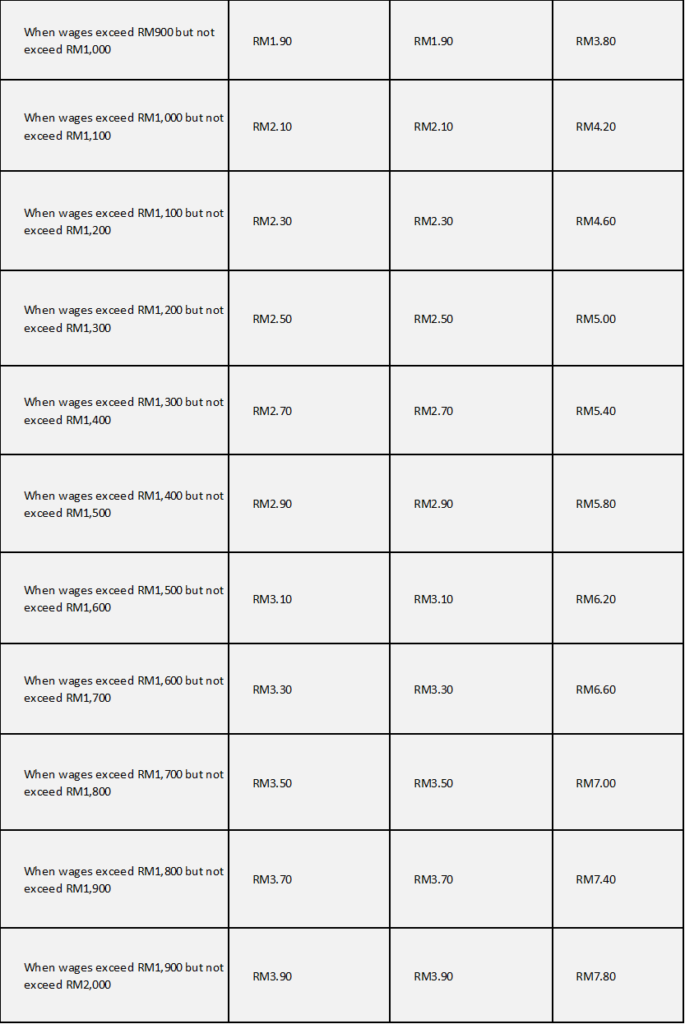

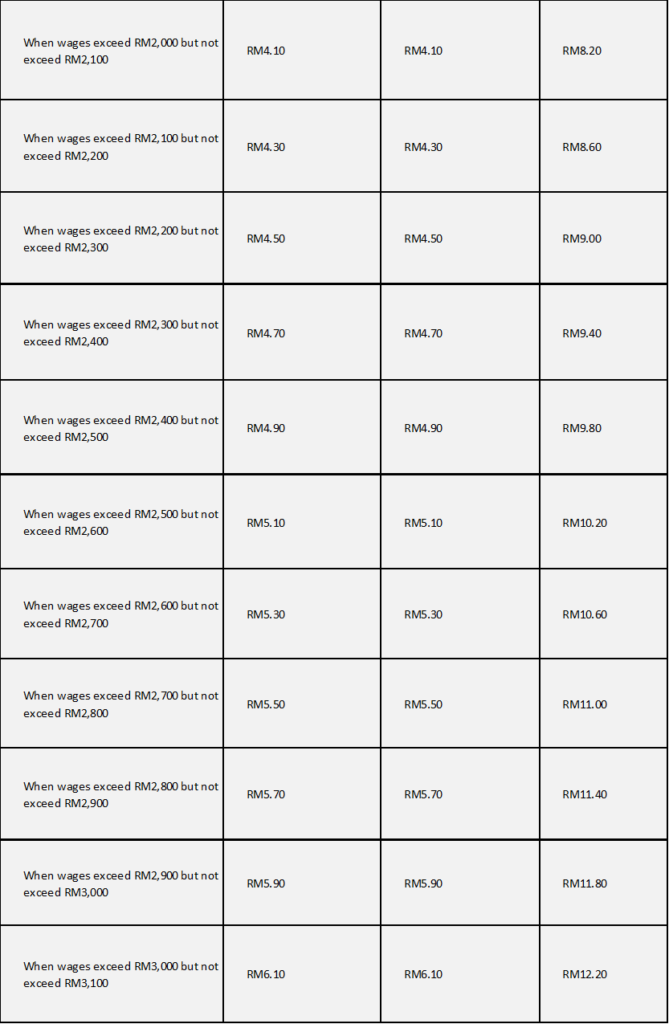

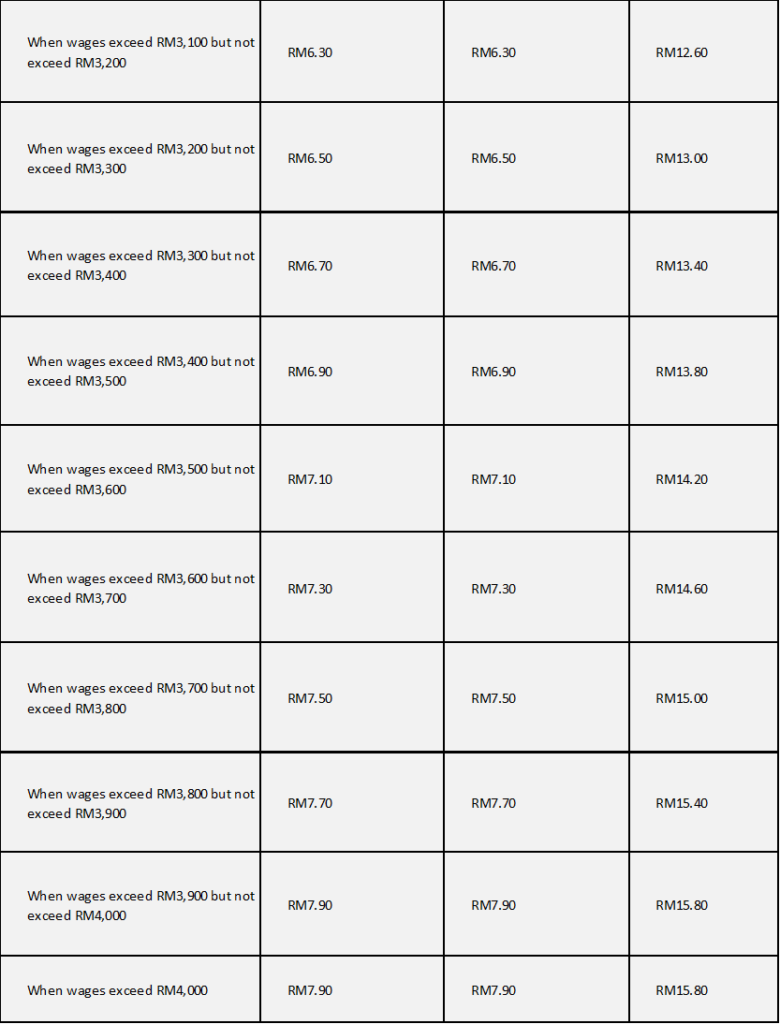

SOCSO Table 2022 for Payroll Calculator Malaysia

SOCSO (Social Security Organization), also known as PERKESO (Pertubuhan Keselamatan Sosial), is a government agency that was established to provide social security protections to Malaysian employees. Since June 2016 all Malaysian and permanent resident employees must contribute to SOCSO table for payroll calculator malaysia. As of Jan 2019, all foreign workers must contribute as well.

SOCSO table has two insurance schemes for its members:

Employment Injury and Invalidity Scheme for Socso Table 2022 for Payroll Calculator.

All employees younger than 60 years old contribute under this category, unless they began contributing at the age of 55 or above.

Under this category, every month, the employer contributes a value based on the employee’s monthly salary up to a maximum value of RM 69.05, and the employee contributes up to a maximum value of RM 19.75

3.4.2 Employment Injury Scheme for Socso Table for Payroll Calculator Malaysia

Employees who are 60 years old and above, and those who began contributing to SOCSO table for payroll calculator at the age of 55 or above, contribute under this category, as well as insured people receiving an invalidity pension while still working, and receiving less than one third of their average monthly salary before invalidity.

As of January 2022, foreigners will be contributing under socso table only.

Under this category, every month, the employer contributes a value based on the employee’s monthly salary up to a maximum value of RM 49.40. There are no employee contributions in payroll calculator.

Exempt Payment of Socso Table 2022 for Payroll Calculator Malaysia

‘’Wages” for contribution purposes refers to all remuneration payable in money by an employer to an employee, and include:

The following payments for payroll calculator are not considered “wages” and are not included in the calculations for monthly deductions:

Socso Table 2022 for Payroll Calculator Malaysia

Types of Forms Related For Payroll Calculator

Forms for Payroll Calculator | Descriptions | |

Monthly Forms | PCB | Form CP39 or online. |

To submit by the 15th of the following month (or previous working day if 15th is a holiday) | ||

EPF | Form A or online. | |

To submit by the 15th of the following month (or previous working day if 15th is a holiday) | ||

SOCSO | Form 8A or online. | |

To submit by the 15th of the following month (or previous working day if 15th is a holiday) | ||

EIS | Online or submit ECR file OR Emailing the Lampiran Excel file. | |

To submit by the 15th of the following month (or previous working day if 15th is a holiday) | ||

Annual Forms | Form E | Statement of remuneration paid to employees and PCB deducted during the year; must be submitted to LHDN by 31st March of the following year. |

Form EA (C.P. 8A) | Statement of remuneration paid to an employee during the year; must be issued to the employee by the last day of February of the following year in order for them to prepare their tax return; not submitted to LHDN. | |

Related Forms for Payroll Calculator | CP21 | Notification for those leaving Malaysia for an extended period or permanently |

CP22 | Notification of new employee subject to income tax (Applicable for Public & Private Sector) | |

CP22A | Notification for those retiring from employment (Only Applicable for Private Sector) | |

Contact Us For More Details on Payroll Software Malaysia

We specialized in smart systems such as Payroll for both Singapore and Malaysia, Time and Attendance Management System (TMS) which able to integrated with variety of Biometrics Devices including Fingerprint, facial and handpunch. We also provide latest BCA EPSS Biometrics Authentication System (BAS) for Singapore BCA ePSS Submission. Others system including, Access Control Solutions, Project Costing Solutions, HR Solutions, Worker Dormitory System, Hostel Billing Managment System, Visitor Management System (VMS), and Cloud based Time Attendance System for multi-chain solutions.

Smart Touch Technology Sdn Bhd

Address: 36-02 & 36-03, Jalan Permas 10, Bandar Baru Permas Jaya, 81750 Masai, Johor, Malaysia.

Contact Number: +607-388 9903

For More Details, please click HERE.

Package Price For Payroll Software Malaysia

Smart Touch Technology “STT” is software, hardware & consultancy company. “STT” is specialized in the field of software development, system integration, implementation, systems support, and marketing of “STT” applications in one single database solution. “STT” has developed programs such as SmarTime (Time & Attendance Systems), Job Costing System, Leave Management System, ID Badges Card System, Security & Access Control System and Visitor Management System.

“STT” is involved in installing numerous systems in both Singapore & Malaysia. “STT” software applications come with standard or customized (according to customers’ specifiction) solutions. The objective of the software design is to offer a flexible user-friendly software that is easy to implement, modify and upgrade.

Click HERE for more Pricing Details >> Package Price