Payslip Template for Payroll Malaysia

All employees in Malaysia should be issued with a payslip template when they are paid, including information such as wages earned and deductions made.

However, most of us dispose a payslip without giving it the due importance. Mainly, because all we want to know is the money we made and how much went to deductions of various types.

Every major organization is preparing Payslip, and it is necessary for financial and legal verification. It is very important for any financial department to verify the information or make the standard information which Payslip will contains.

The quality and clarity of information used in Payslip is common issue in any organization. Hence you can check our Payslip templates and identify information which is most important and fit for your business requirements.

What is payslip template for Payroll Malaysia?

A payslip is a piece of paper given to an employee at the end of each week or month , which states how much money he or she has earned and how much tax has been taken off.

Pay slip, in comparison, is given to workers whose income and allowances can vary according to number of hours or days they work. Regardless, they both indicate your earnings.

Importance of a Payslip Template In Payroll Malaysia

It will decide whether or not you will pay income and other taxes. Your salary slip will also help fix how much money you will pay as taxes every year. In addition, you will know how much income tax returns you can claim from the government.

The salary slip also ensures access to certain services from the government that are given free or with heavy subsidy. This will include state-run medical care and cheaper food grains from public distribution system.

Further, bank credit, loans, housing mortgage and other borrowings you can avail is decided by the salary slip. Banks and lender institutions will definitely ask for copies of salary slip while applying for credit or loan. Pay slips help banks assess your creditworthiness and repayment capability.

A pay slip plays role of a bargaining chip when negotiating salary with a new employer. Large companies ask for copies of the last salary slip as proof of your earnings. It helps them decide how much to pay you.

Unfortunately, salary slips work sometimes against income earners facing divorce proceedings. For males, it will be used to decide how much alimony to pay. In the case of women, the alimony and compensation they get will be based on the husband’s salary slips.

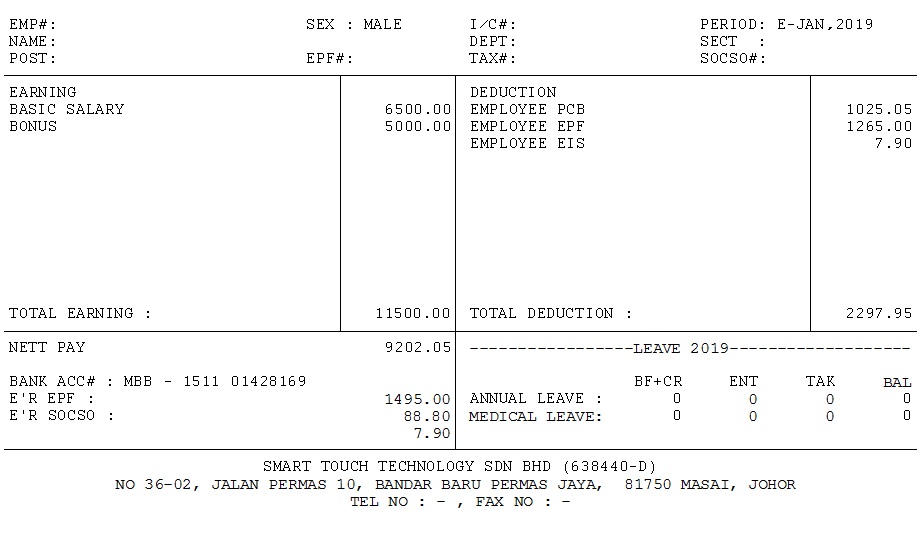

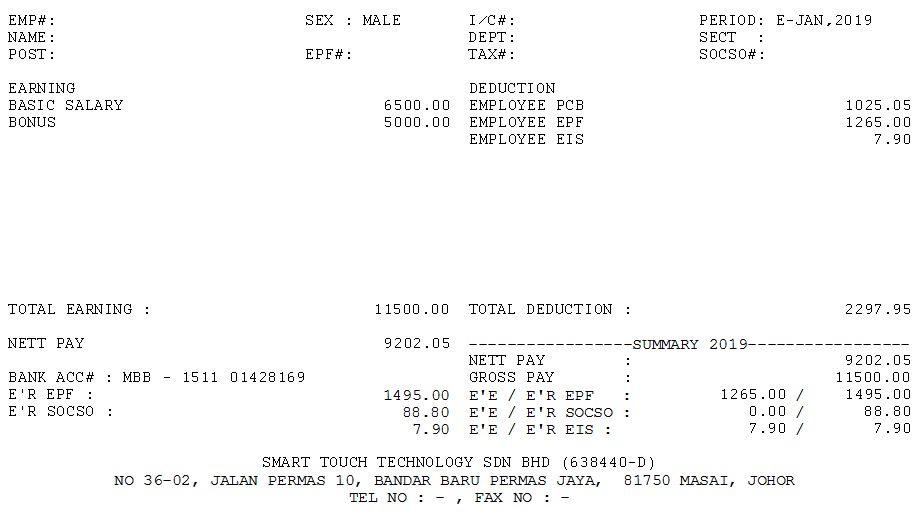

Payslip Template Using Excel for Payroll Malaysia

This is a simple salary slip in Excel with general format you may use for your purposes. If you are small business owners where you are running your business with a small number of employees, you might find this useful since you can modify it to meet your own needs.

Or, if you are a Human Resources Manager, you may need this as reference to generate your own format. The main benefit of having this form in Excel over Word is you don’t have to calculate the salary manually. You just need to put correct excel function to calculate the data.

Payslip template is well professionally designed format with all features and details. Actually, this format had made in excel for easy to everyone on after download for customization for individual use.

Now days, many companies are using payroll system which made by auto application / software generate and sending each employee on its email. But for small scale industry, it can be costly and unusual if make financial burden. Hence excel formatted Payslip is best option in this regards.

Type of Payslip Template In Payroll Malaysia

- Normal Pay

A normal pay is the normal payment an employee receives each pay period. It includes their salary or wages, plus any penalty payments, allowances and expenses. A normal pay can be created manually, by adding a new payslips to the pay calculation screen, or automatically using the open new period process. There can only be one normal pay per payee per pay period.

- Adjustment Pay

There can be any number number of adjustment payslips per payee per pay period, and each one must be added manually using the pay calculation screen. To add additional adjustment payslips, you must increment the payslip sequence number on the pay calculation screen for each additional one.

- Supplementary Pay

An supplementary payslip is a second or subsequent pay to a payee in a pay period after a normal pay has been processed. You might use a supplementary payslips to pay for overtime or some other payment that was not known about when their normal pay was processed. There can be any number number of supplementary payslips per payee per pay period, and each one must be added manually using the pay calculation screen. To add additional supplementary payslips, you must increment the payslip sequence number on the pay calculation screen for each additional one.

Contact Us For More Details on HR Software Malaysia Solution with Payslip Template

We specialized in smart systems such as HR Software Malaysia and Singapore, Time and Attendance Management System (TMS) which able to integrated with variety of Biometrics Devices including Fingerprint, facial and handpunch. We also provide latest BCA EPSS Biometrics Authentication System (BAS) for Singapore BCA ePSS Submission. Others system including, Access Control Solutions, Project Costing Solutions, HR Solutions, Worker Dormitory System, Hostel Billing Managment System, Visitor Management System (VMS), and Cloud based Time Attendance System for multi-chain solutions.

Smart Touch Technology Sdn Bhd

Address: 36-02 & 36-03, Jalan Permas 10, Bandar Baru Permas Jaya, 81750 Masai, Johor, Malaysia.

Contact Number: +607-388 9903

For More Details, please click HERE.

Package Price For HR Software Malaysia Solution with Payslip Template

Smart Touch Technology “STT” is software, hardware & consultancy company. “STT” is specialized in the field of software development, system integration, implementation, systems support, and marketing of “STT” applications in one single database solution. “STT” has developed programs such as HR Software Malaysia, SmarTime (Time & Attendance Systems), Job Costing System, Leave Management System, ID Badges Card System, Security & Access Control System and Visitor Management System.

“STT” is involved in installing numerous systems in both Singapore & Malaysia. “STT” software applications come with standard or customized (according to customers’ specifiction) solutions. The objective of the software design is to offer a flexible user-friendly software that is easy to implement, modify and upgrade.

Click HERE for more Pricing Details >> Package Price