Key Highlights of Penjana Economic Stimulus Package in Malaysia

Malaysia issued economic stimulus package, named the Pelan Jana Semula Ekonomi Negara (PENJANA Malaysia), which is primarily aimed at helping businesses recover from the impact of the coronavirus pandemic.

The latest package is valued at 35 billion ringgit (US$8.1 billion), bringing the total value of the country’s stimulus packages to over 290 billion ringgit (US$67 billion). Some of the measures issued in Penjana include new tax incentives, financial assistance for small and medium-sized businesses (SMEs), and job protection initiatives.

Tax Incentives

Flexible Work Arrangement (FWA) Penjana Incentives

- Tax deduction for employers which implement FWAs or undertake enhancement of their existing FWAs

- Tax exemption of up to RM5,000 to employees provided with handphone, notebook and tablet by their employer

- Personal tax relief of up to RM2,500 to individuals who purchase handphone, notebook and tablet

Relief for Child Care

- Tax relief of up to RM2,000 is given to resident individuals who enroll their children aged 6 years and below in child care centres or kindergartens registered with the Department of Social Welfare or the Ministry of Education.

Special income tax relief for domestic travelling expenses

- tax relief for accommodation fees on tourist accommodation premises registered with the Ministry of Tourism, Arts and Culture Malaysia.

- Tax Relief for entrance fees to tourist attractions.

Tax deduction for Covid-19 related expenses

- Expenses incurred by companies to provide employees with disposable Personal Protective Equipment (PPE) e.g. face mask, be given tax

deduction and non-disposable PPE products be given capital allowance.

Financial stress support for businesses

- Extension of special tax deduction for renovation and refurbishment of business premises to 31 December 2021.

- Extension of Accelerated Capital Allowance on eligible capital expenditure on machinery and equipment including ICT equipment to 31December 2021.

- Extension of period of special deduction to property owners who provide at least 30% rental reduction to their SME tenants to 30 September 2020.

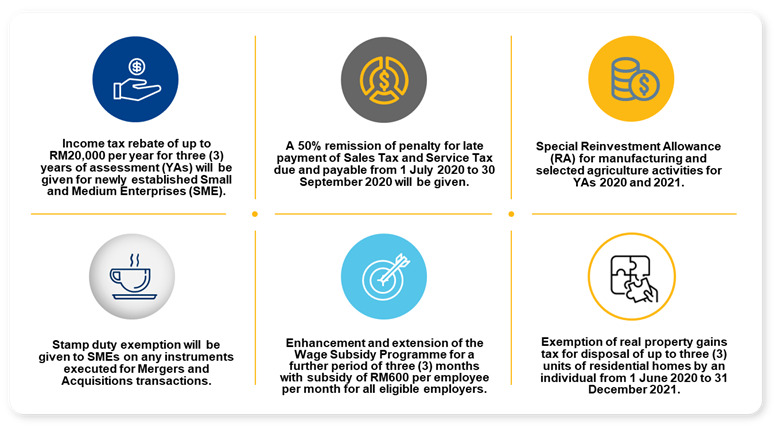

Set-up of new businesses

- Financial relief be provided in the form of income tax rebate of up to RM20,000 per year for the first 3 years of assessment for newly established SME between 1 July 2020 to 31 December 2021.

RPGT exemption for residential properties

- RPGT exemption will be given to individuals who are citizens of Malaysia for disposal of residential properties from 1 June 2020 to 31 December 2021.

Tax incentives for new investments in Malaysia

- 0% tax rate for 10 years for new investment in manufacturing sectors with capital investment between RM300 million to RM500 million. Operation must commence within 1 year from the date of approval and capital investment must be made within 3 years.

- 0% tax rate for 15 years for new investment in manufacturing sectors with capital investment above RM500 million. Operation must commence within 1 year from the date of approval and capital investment must be made within 3 years.

- 100% Investment Tax Allowance for 5 years for existing company in Malaysia relocating overseas facilities into Malaysia with capital investment above RM300 million.

- Special Reinvestment Allowance for manufacturing and selected agriculture activity, from year of assessment 2020 to year of assessment 2021.

Corporate Tax for Penjana Incentives

Deferment of tax instalment for the companies in the tourism industry

- To reactivate the activities of the tourism sector, it is proposed that the deferment of monthly income tax instalment payments for companies in the tourism industry to be extended from 1 October 2020 to 31 December 2020.

Sales and Service Tax for Penjana Incentives

Sales tax exemption on passenger cars

- 100% sales tax exemption will be given on the sale of locally assembled passenger cars while 50% sales tax exemption will be given on imported passenger cars until to 31 December 2020.

Service tax exemption on accommodation services

- Service tax exemption on accommodation services premises which extended to 30 June 2021.

Financial stress support for businesses

- 50% remission of penalty will be given for late payment of sales tax and service tax due and payable from 1 July 2020 to 30 September 2020.

Others Penjana Incentives

- Stamp duty exemption is given to Small Medium Enterprises (SMEs) on any instruments executed for Mergers and Acquisitions (M&A) transactions completed between 1 July 2020 to 30 June 2021.

- Instruments of transfer and loan agreements for the purchase of residential homes priced between RM300,000 to RM2.5 million will be exempted from stamp duty.

- This stamp duty exemption is applicable for sale and purchase agreements on residential properties executed between 1 June 2020 to 31 May 2021 and is subject to the developer providing a discount of at least 10%.

- Tourism tax will be fully exempted from 1 July 2020 to 30 June 2021.

- 100% export duty exemption will be given on crude palm oil, crude palm kernel oil and refined bleached deodorised palm kernel oil effective from 1 July 2020 to 31 December 2020.

- The subsidy program is now extended for a further 3 months and the subsidy amount is fixed at RM600 per employee for all eligible employers, up to a maximum of 200 employees per company.

- The subsidy programme is also enhanced to:

– Allow employers receiving wage subsidy to implement reduced work week (e.g. 4-day work week with a reduced pay of 20%) and reduced pay (the maximum allowable reduced pay is 30%).

-Allow employers to receive wage subsidy for employees on unpaid leave, subject to the employees receiving the subsidy directly (only applicable for tourism sector and business which are prohibited from operating during CMCO).

- Youth – RM600 per month for apprenticeships for school leavers and graduates for up to 6 months

- Unemployed workers

– RM800 per month for employment of workers below 40 years old who are unemployed for up to 6 months

– RM1,000 per month for employment of disabled workers or workers 40 years old and above who are unemployed for up to 6 months

– Training allowance of RM4,000 per individual will be extended to those retrenched but not covered under the Employment Insurance Scheme (EIS).